Financial accounting and Traditional Costing Systems vs. Activity-Based Costing Systems

Financial Accounting is what a business’s accountants do that’s essential for a business to comply with statutory reporting and filing of returns. Financial Accounting, as guided by GAAP or specifically IFRS and ASPE, focus on the compliance aspects of accounting for reporting to external stakeholders and to support tax returns. Reporting under GAAP, gives a picture of the overall financial performance and well being of a business.

On the other hand, Management Accounting goes beyond Financial Accounting and considers both financial and quantitative and operational data to support strategic business decisions and provide an in depth analysis of performance, looking at specific areas for imrovement. The costs of the business as a total are reflected through the standard financial accounting systems. This adequately serves the management needs of businesses which have just one or a very limited number of similar products or services. Costs for these businesses are easily traced to these limited number of products or services.

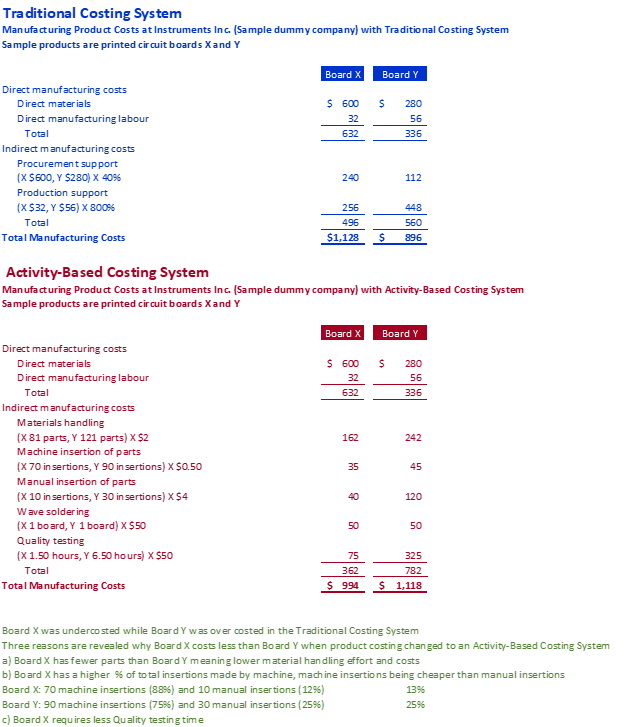

When a business has a mix of products and/or services that are different from each other, the costs that are directly incurred for each product or service are visible to the management (like material and labour specific for the product/service). However, it is the costs that are indirect and are common to many products and services and support costs that make the task of determining the total costs of each product or service a challenge.

Financial Accounting or traditional Cost Accounting methods distribute such common costs uniformly over all products or use simple allocation methods like % of total manhours or a uniform business-wide overhead rate. This can be quite misleading for the following reasons.

Mis-allocated costs can show products or services that are in realty profitable as unprofitable (over-costing) and vice versa (under-costing). Decisions made on such cost information can be disastrous for a business. Some products may not be promoted or may be dropped where they are profitable and others that are loss-makers may be encouraged. Inaccurate customer quotations will lead to serious loss of business opportunities.

The following illustration derived from “Cost Accounting: A Managerial Emphasis” by Horngren, Foster and Datar, demonstrates the impacts of relying purely on financial accounting or moving from a traditional costing system to a more accurate Activity-Based Costing system.

Please also view the Activity-Based Costing based detailed Power BI Report for a sample firm Imagine Machine Works.

We, at BJM Management Accounting Inc., will thoroughly study your processes, your financial data and the activities that drive your costs and revenue to provide you a complete cost and management accounting system that will throw light on any issues that currently impact your business performance and will recommend measures to improve your business.